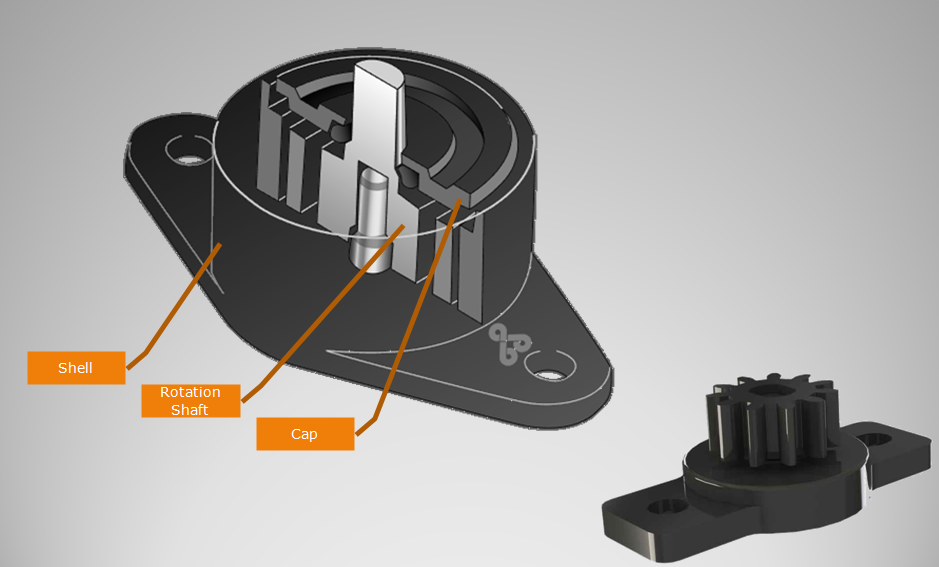

According to statistics, in 2014, China’s domestic titanium ore production exceeded 4 million tons for the first time, setting a new record for titanium production in China. According to the customs import data, in 2014, China imported a total of 2.02 million tons of various titanium ore raw materials, a decrease of 10.93% compared with 2013, a significant drop. The significant increase in production of titanium ore in the Panzhihua area for two consecutive years is the main reason for the sudden increase in titanium production in China. Panzhihua titanium mine output exceeded 3 million tons this year, accounting for nearly 4/5 of the total domestic production. The production of titanium from the Chengde area in Shandong was roughly the same as in 2013. However, production of titanium ore in Yunnan and Hainan declined. Among them, the large-scale production stoppages in the Yunnan region have occurred due to excessive price declines. In Hainan, affected by the typhoon, the mine was destroyed and some of the mines were still not repaired, resulting in reduced production in Hainan. China's self-sufficiency rate of titanium ore has reached the “Twelve-five-vanadium-titanium industry planning†requirement in advance. In 2012, the national requirements for the “Twelve-five V-vanadium and titanium industry plan†require China to strive to achieve a total of 400 domestic titanium mines by 2015. Ten thousand tons, titanium self-sufficiency rate reached 67%. This goal has been achieved ahead of schedule in 2014. It is believed that the stable supply of domestic titanium ore is of great significance for the stable development of China's titanium industry. First, the stable supply of domestic titanium ore can guarantee the deep processing industry to concentrate on development without worrying about being troubled by raw material supply. Recall that during 2011-2013, domestic processing companies were very concerned about the export policies of titanium mines abroad. Among them, the most obvious is Vietnam's export quota policy for titanium mines in China. The Vietnamese government has been revising the titanium ore export quota every year. Due to geographic location and other reasons, China is the largest user of Vietnam's titanium ore. The annual amount of titanium ore imported from Vietnam accounts for more than 20% of domestic demand. From 2011 to 2012, affected by diplomatic disputes between the two countries, Vietnam subsequently stopped exporting titanium ore to China, resulting in tight supply of titanium ore in China, and some factories appeared to have “no rice potsâ€. On the other hand, this year, the amount of titanium ore imported from China has shrunk dramatically. Except for the factors of market fluctuations, it has been largely occupied by domestic ore mines. While China's titanium industry is in a period of development, the stable supply of raw materials is crucial to ensure the healthy development of the titanium industry. Second, the stable supply of domestic titanium ore can maintain market prices and avoid being pushed up by foreign mining prices, making the profits of domestic deep-processing companies swallowed. Prior to 2013, the titanium industry in China was consistently more than 50% dependent on imported titanium. This has caused the titanium industry in China to face the embarrassing situation of rising titanium ore prices from time to time. In the period from the end of 2010 to mid-2011, the price of titanium ore was increased from around RMB 1000/tonne to RMB 3,000/tonne abroad. The profit margins that domestic companies obtained through a series of improvements were greatly engulfed. Companies pay for investment, experience painstaking improvement, and take risks. As a result, they have done a lot of work for foreign mines. We should not go through this outcome for the second time. Volume increase minus 2014 titanium industry in China In 2014, with the exception of maintaining a high growth rate of titanium ore production, the production of titanium dioxide in China continued to grow at a relatively rapid rate, which was about 14% higher than that of 2013. However, while the output keeps growing at a high rate, the price of the product has been declining and the operating pressure of the company has increased. According to statistics, the average annual price of rutile titanium dioxide in China was 14,643 yuan per ton in 2013, while in 2014 it fell to 12,985 yuan per ton, a decrease of 12.8%, which was almost flat with the increase in output. In other words, despite the significant increase in the production of titanium dioxide in China this year, the total sales of the industry have not achieved synchronous growth, and the stubborn malady of profitability still plagues most companies. In addition, China's titanium dioxide exports this year reached a record high of 550,000 tons, an increase of 30% year-on-year. However, in addition to the reason for the low price, such a huge increase in the quality of titanium dioxide products in China has been recognized by the international market is also an important factor. The future of Chinese companies participating in international competition is even more worth looking forward to. In 2015, the market for sponge titanium and titanium materials shrank slightly. It is predicted that in 2014, titanium titanium production in China will drop by about 12% year-on-year. With the weakening of the market, some sponge titanium enterprises could not afford to suffer huge losses and were forced to withdraw from the market. Among the companies still operating, they have continued to lose money. It can be said that after more than two years of market baptism, the layout of China's sponge titanium industry has been optimized. This kind of optimization may be cruel and the price is not small, but these costs are undoubtedly worthwhile in exchange for the healthy development of the industry in the future. In addition, although titanium sponge production has declined this year, it is still in a state of oversupply compared with the market demand. It can be foreseen that China's sponge titanium market has not yet emerged from the stage of big waves, and market competition will continue. In 2015, companies still face price competition and maintain market share. How to coordinate the relationship between production and inventory, and how to achieve the most economical production method will become the subject that each company needs to solve. Rotary Damper with gear. Gear Damper is used to dampen drives, control speed, and many other applications. Gear dampers are widely used in automobile interior decoration, household electric appliances,etc. Gear damper increasing equipment life and reducing maintenance expenses.

NOTE:

1. Please contact the corresponding product engineer for specific torque products.

2. Max. rotation speed: 50r/min

3. Max. circle rate: 6 cycle/min(Clockwise360 °, 360 ° anti-clockwise for 1 cycle)

4.Operating temperature: -10~50℃

5.Storage temperature:-30~80℃

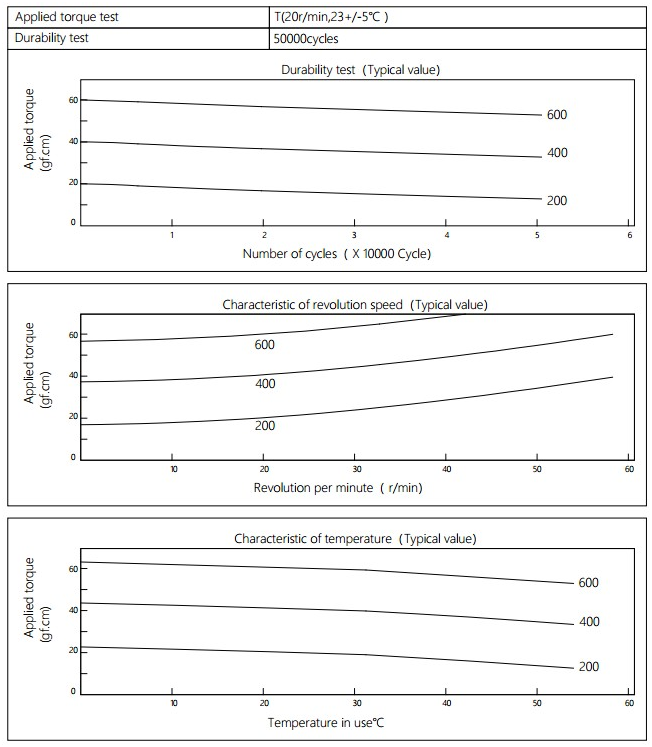

Applied torque: (T)

Test Temperature: 23+/-5℃

Rotating speed:20r/min

Durability test Method: Clockwise 360 °, 360 ° anti-clockwise

Rotating speed:20r/min

Test Frequency: 1cycle/min

Test Temperature: 23±5℃

Durability test cycle: 50000cycle

Test result criteria: Store in the room temperature for 24 hours or more after the test, recording to the torque T=T±30%T.

Gear Damper Gear Damper,Hinge Dampers,Plastic Gear Damper,Small Rotary Gear Damper,Decoration Gear Damper Shenzhen ABD Equipment Co., Ltd. , http://www.abddamper.com