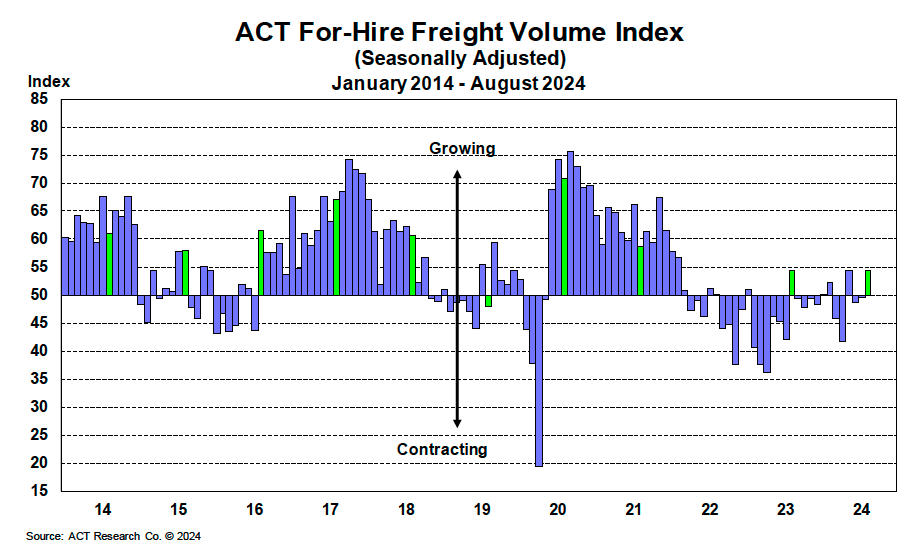

Booming economic activity leads to an increase in the amount of freight that needs to be transported. Freight volume refers to the total quantity of goods, both imports and exports, that move through the transportation sector. Nearly every physical product produced or sold in the U.S. economy passes through the commercial vehicle (CV) market. Understanding freight volume is essential for businesses operating in any economic climate. It provides valuable insights into market trends, allowing companies to better anticipate challenges and seize opportunities. Shippers are the ones who own or supply the goods, while carriers transport them, with brokers acting as intermediaries. The volume of freight moving between these players directly affects how each party operates. Having accurate data on freight volume helps businesses make informed decisions and plan more effectively for the future. A helpful way to visualize supply and demand in the truckload (TL) market is through the concept of a pendulum. When demand outpaces available capacity—such as when there's a shortage of drivers or tractors—the pendulum swings in favor of the carriers, leading to higher freight rates. Conversely, when supply exceeds demand, the pendulum shifts toward the shippers, causing rates to drop. This back-and-forth dynamic makes matching long-term business needs with short-term fluctuations a continuous cycle. For many companies, internal data may not provide a complete picture, and gathering broader market analysis can be costly. To address this, ACT Research collects confidential information from a wide range of truckload (TL) carriers, especially small and mid-sized ones that handle a significant portion of North American freight. The data collected includes: The ACT For-Hire Trucking Index surveys carriers to offer a comprehensive view of the transportation and commercial vehicle markets. Additionally, ACT Research partners with Cass Information Systems, Inc.—the largest processor of freight billing in the U.S.—to gain deeper insights into current market conditions and the state of the shipping industry. ACT uses the Cass Freight Index®, which tracks freight volumes and spending, and the Truckload Linehaul Index®, a pricing indicator, to forecast freight demand. As of October 2024, freight volumes have remained relatively stable throughout the year, but the year-over-year (y/y) comparison shows positive momentum. The ACT For-Hire Trucking Index averaged 48.8 in the first half of 2024, up from 42.8 in the same period last year. Despite ongoing consumer pressure, real U.S. retail sales have grown by 1.8% year-to-date, supported by continued disinflation. Moreover, intermodal and import volumes are showing positive trends, contributing modestly to overall surface freight volumes. While private fleet insourcing has likely reduced some demand in the for-hire market, recent declines in U.S. Class 8 tractor sales suggest a slowdown in private fleet expansion. This shift highlights the evolving nature of the freight landscape and the importance of monitoring key indicators for accurate forecasting. When forecasting the truckload and less-than-truckload markets, ACT Research relies on two primary metrics to gauge industry demand: Both metrics reflect consumer demand driving the movement of goods. In other words, they measure the actual volume of freight being transported. The Cass Freight Index® - Shipments tracks the number of freight shipments processed within North America by Cass Information Systems. With over $44 billion in annual freight transactions, Cass is a trusted source for measuring shipper activity. The ACT Freight Composite Index estimates the total freight volume hauled across different sectors, as calculated by ACT Research. These two demand metrics help predict future freight volumes over the next 6–36 months, offering a clearer picture of the supply-demand balance when combined with ACT’s capacity metrics. To understand how freight volume might evolve in the coming months and for detailed forecasts on truckload, less-than-truckload, and intermodal, visit ACT's freight & transportation forecast report. Blowing Machine,Pet Blowing Machine,Water Bottle Blowing Machine,Oil Bottle Blowing Machine Taizhou Langshun Trade Co.,ltd , https://www.longthinmachinery.comWhy Is Freight Volume Important?

How is Freight Volume Measured?

What is ACT saying right now about freight volume?

Freight Volume Forecasting